Since its creation in 2009, Bitcoin (BTC) has remained the most recognized and widely traded cryptocurrency.

But as we step into 2025, the question many newcomers ask is: “Is Bitcoin still a safe investment?”

With its dramatic price swings, global headlines, and endless debates, Bitcoin continues to attract both excitement and skepticism.

In this guide, we will break down the strengths of Bitcoin, the risks to consider in 2025, and the essential principles every beginner should follow before making their first investment.

1. The Strengths of Bitcoin

(1) Limited Supply (21M BTC)

Unlike fiat currencies that can be printed infinitely, Bitcoin has a hard cap of 21 million coins. This scarcity often leads people to call it “digital gold.”

(2) Global Accessibility

Bitcoin can be bought, sold, and transferred almost anywhere in the world. It’s available on all major exchanges, and peer-to-peer trading is always an option.

(3) Long Track Record

As the first cryptocurrency, Bitcoin has the longest history and the largest market capitalization. It has survived multiple crashes, bear markets, and regulatory challenges.

(4) Institutional Adoption

Companies like Tesla, PayPal, and even traditional banks now integrate Bitcoin into their services or hold it as part of their balance sheet.

2. Risks of Bitcoin in 2025

While Bitcoin has many strengths, it is far from risk-free. Here are the key concerns for 2025:

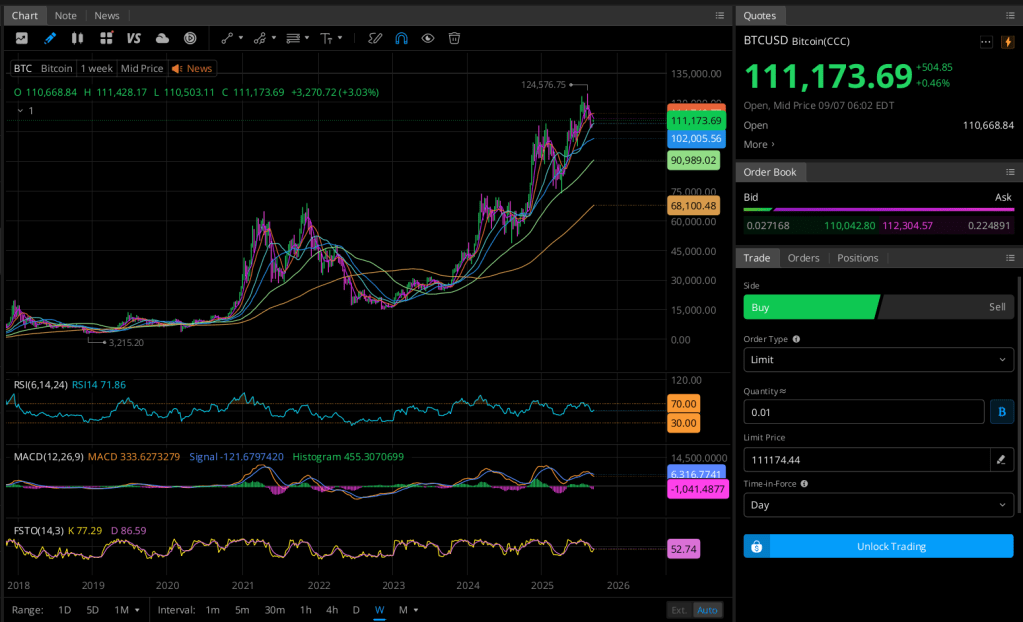

(1) Price Volatility: Bitcoin can move 5–10% within a single day. This makes it exciting but also risky, especially for short-term traders.

(2) Regulation: Governments are increasingly focused on crypto. The U.S., EU, and other jurisdictions may introduce stricter laws.

(3) Competition: Altcoins, meme coins, and newer blockchains (like TON) can attract capital away from Bitcoin.

3. A Beginner’s Investment Checklist

If you’re a beginner, here’s a practical checklist to reduce your risks:

(1) Start Small – Only invest money you can afford to lose.

(2) Secure Your Assets – Use two-factor authentication (2FA), and consider a hardware wallet for larger holdings.

(3) Think Long-Term – Instead of chasing short-term gains, adopt a dollar-cost averaging strategy.

(4) Stay Updated – Follow news, join Telegram groups, and keep an eye on trends.

4. Why Bitcoin Is Safer Than Most Altcoins

Many altcoins come and go, but Bitcoin has remained dominant for over 15 years.

(1) It is the most liquid crypto asset.

(2) It has the strongest brand recognition.

(3) In times of uncertainty, investors tend to move back into Bitcoin, reinforcing its status as a “safe haven.”

Yes, projects like TON blockchain are growing fast and have exciting features. But for a beginner, Bitcoin remains the most reliable entry point into the crypto world.

Conclusion

Bitcoin is still a high-risk, high-reward asset in 2025.

But compared to other cryptocurrencies, it offers unmatched liquidity, accessibility, and trust.

👉 For beginners, Bitcoin remains the most rational starting point.

The key is not to expect guaranteed profits, but to understand the risks, stay informed, and approach it with a long-term mindset. 🚀

“With the upcoming U.S. interest rate cuts, shifts in the bond market, and the weakening value of the dollar, 2025 could present one of the best opportunities to buy Bitcoin.”

Disclaimer: This content is for informational purposes only. It is not financial advice or an encouragement to invest.

Leave a comment